*** FUTURE POSTS WILL ALSO APPEAR AT 'NOW AND NEXT' : https://rolfnorfolk.substack.com

Saturday, May 24, 2008

The Oil Controversy

I should like to see what energy commentators like Nick Drew wish to say to this. From what I've read, remaining oil stocks are likely to be of lesser quality and will cost far more to extract than God's gift to the Saudis (which, I understand, is already being exploited at a rate that is damaging the field).

Granted, oil is massively over-taxed. Americans would head for their gun rooms if they had to pay £5 a gallon.

Meanwhile, the FTSE continues to float cheerily above 6,000 and the Dow above 12,000 - for how much longer?

Sunday, May 18, 2008

It's going to be bad...

We in the UK will not be immune from the general economic malaise to follow, even if unregulated immigration and a slower past housebuilding program help keep our housing assets from falling quite so far.

Saturday, May 17, 2008

Any room for dissent?

And with a disgraceful click, the supposedly diverse panel closed ranks behind China, despite some attempt by the chairman to generate at least a little debate. We heard that we have been indulging in "China-bashing" lately, and now that this earthquake has happened, we should stop all this nonsense about China's human rights and/or ecological violations.

I began to wonder whether there might be some business and party-political interests to declare, for I've rarely heard such a combination of unanimity and superficial reasoning. The message seemed to be, "Stop talking about Tibet, look at this crisis instead."

That's imposing a false perspective. China's own news media currently reckon the death toll from this terrible quake to be under 29,000; but "According to various estimates, up to 1.2 million Tibetans have died due to the Chinese occupation and various political campaigns since the Dalai Lama fled his homeland in March 1959." So in cold mathematical terms, Tibet has suffered a death toll 40 times as great - and far more avoidable. Why should a recent misfortune be the pretext for ignoring a long-standing injustice?

And as for rubbishing ecological concerns, there will come a time (and quite soon) when we have forgotten in which year this quake happened, but we will be dealing with the multifarious fallout of China's economic, demographic and ecological problems. For China is a distressed giant thrashing about in the small house of this world.China's population last year was estimated at about 1.3 billion, and in the next ten years or so is expected to increase by maybe another 100 million. Over the last 60 years, life expectancy has more than doubled and infant mortality has reduced. So despite the one-child-per-family policy (not universally applied in China), the population continues to grow.

And, as time goes by, it is becoming a demographically unbalanced population. Thanks to the preference for sons, there is a disparity between male and female. Should China decide to become warlike in the conventional manner, she will have an almost limitless supply of expendable single men. (Meanwhile, Russia's population threatens to decline to such a degree that reversing the trend was "a key subject of Vladimir Putin's 2006 state of the nation address".)

Less frightening for us, but surely very worrying for the Chinese, must be the growing imbalance of numbers between young and old. Imagine a young Chinese couple who have their one child, but face supporting four elderly parents. And when that child grows up, perhaps up to 6 parents-cum-grandparents (up to 12, after marriage). And the healthcare costs!

And with a smaller proportion of girls surviving to breeding age, the demographic waist will be pinched further. Perhaps the one-child policy will eventually be abandoned.

Meanwhile, China's burgeoning populace must be fed, but how? Changes in diet and the progressive loss of arable land, and reducing yields from such land as is still fertile, have been a serious concern for a long time (see e.g. here).

Then there's the demand for water, and energy, and how to have breathable air while exploiting China's giant coal reserves and rapidly expanding heavy industry.

It's far too simple to make China into a villainess, but she faces enormous difficulties on the road away from her past abject poverty and suffering. These translate into mighty pressures that the rest of the world will feel. We must find a way to assist China in the solution of her problems - but self-censoring discussion of her external relations will not help us find realistic answers.

Check your bank deposit security

Wednesday, May 14, 2008

Sunday, May 11, 2008

The sky is dark, wings are flapping

Karl Denninger notes that in both the US and Japan, there are moves to force full disclosure of the banks' poor-grade assets; Jim in San Marcos reprises some observations of what happens when mutual funds (collective investments) are told by worried investors to "switch to cash" or simply pay out.

Look out for a hole in the henhouse roof, and a cloud of feathers.

Saturday, May 10, 2008

Nationalism and internationalism

I don't think nationalism will be confined to losers in the game, or rejected by those who claim to love all mankind. Once there was Bukharin/Stalin's "Socialism in one country"; soon it'll be "China first". I can't blame the latter - they have worked so hard for what they've got, and won't understand why we think we can whinge it all back from them.

Speaking as the man in the street, my perception is that we have had a long period in which global businesses and a carpetbagging international managerial class developed and made fortunes. The liberal economists say this system is great for all of us, and should stay that way; perhaps so, if we had honest money and sound national budgets, so the correction mechanisms could steer the course of international trade more steadily.

But thanks to criminal negligence, incompetence and greed by those who could have maintained the integrity of the economic system, I think the aspirant working class and lower middle class in the developed world are paying heavily, and will pay more heavily. As they give up on their aspirations, we shall see a ballooning underclass, increasing the drag on national economic performance; but the situation may prove impossible to change for electoral reasons in a sort-of-democracy. The gap between rich and poor in our countries has widened, but will widen further: "Devil take the hindmost."

At the same time, on both sides of the Atlantic, people suspect a sell-out by the political class, which is intertwined (professionally and often maritally, or extra-maritally) with the business, media and public relations people. I have often said that I think we are seeing the reconstruction of the aristocracy in Europe. Many Americans also fear that their society is moving away from its historic and constitutional foundations.

The implications for democracy, social cohesion and international relations are worrying.

Tuesday, May 06, 2008

Bust - or false boom and mega-bust?

This also chimes with what Marc Faber said last year: the crisis should be allowed to burn through and take out some of the players. Of course, those who are in a position to "allow", are part of the club that includes the players, and there's the rub.

Monday, May 05, 2008

Still room for wonder

It's a little early but the programme should soon appear online here.

UPDATE - now online here (requires RealPlayer to view).

Quote of the day

says Mish, daringly criticising Warren Buffett, who has declared a $billion-plus loss on short bets in the market.

Sunday, May 04, 2008

The system does not care

Not all the individuals can be blamed - you can lose your job for going beyond your brief, or shortcutting protocol.

But don't expect a pantomime horse to win the Derby, and don't expect compassion and commitment from these reified functions that we used to perform for ourselves.

Maybe only embarrassment will make a difference. Please pass on the link to Callum's site.

http://calumcarr.blogspot.com/2008/05/those-who-read-yesterdays-post-nhs-mega.html

Saturday, May 03, 2008

Brummies

First, I think the affected contempt for Brummies is a displaced scorn for industrial labour perhaps impermissible to express so baldly in relation to Yorkshiremen and Lancastrians. Imagine such contempt shown for miners!

This is not universal: German engineers put Ing. in front of their names, and may have a kudos similar to that of the medical profession; but British engineers are treated with patrician condescension. Think squaddies in oil-stained Khakis. No place for officers there.

Or picture Repton-educated (though expelled) Jeremy Clarkson, cheerfully displaying his ignorance as he drives the latest wonder constructed by "four blokes bashing metal in an industrial unit". Decades of regarding going into industry as the wooden spoon in life's competition, has brought Britain to our current sorry pass.

Thickos associated with Birmingham include Matthew Boulton, James Brindley, Sir Arthur Conan Doyle, JRR Tolkien, John Baskerville, Sir Edward Burne-Jones etc.

But mostly, Birmingham was too busy making its own and the nation's prosperity - the "cheap tin trays" of Masefield's "Cargoes". Ugh, the proles. Who also made the chain, the anchors, the presses, the lathes and so on that liberated us from guarding sheep as we read our Bibles with frozen fingers.

There may be a London-centric jealousy because Birmingham is not Britain's Second City, but, technically speaking, its first in geographical area and population. It is the largest local authority by a country mile (the "Mayor of London" controls a larger budget, but that "London" is an sort of urban conglomeration imprecisely related to the City of London, the surrounding boroughs, and other local authorities in the greater metropolitan area).

As to accents, few outsiders could pass for Brummies. Attempts to imitate the accent usually sound like a Scouser being strangled; and what is often thought of as a Brummie accent (say, Timothy Spall's Barry in "Auf Wiedersehen, Pet", or Julie Walters' Mrs Overall in "Acorn Antiques") is more like West Bromwich.

The Black Country abounds in accents; when I first came to Birmingham a Black Country-born history teacher told me that it was once possible to identify by his speech not only the village of the interlocutor, but sometimes even his street.

My personal preference is Sedgley, an exceptionally musical tone. Their pronunciation of the word "flowers" makes me think there must indeed have been a Golden Age in which men sang rather than spoke.

Pay up, or default

We have recognized $300 billion of losses but it has all been derivative loss. The $2.5-$3 trillion in credit loss from housing is still to come, plus all the credit card and other debt that cannot be paid down, likely a couple hundred billion more - at best.

= c. 20% of US GDP.

Friday, May 02, 2008

The system is now out of control

Thursday, May 01, 2008

The pocket calculator reveals the truth

A spendidly indignant Karl Denninger explains how the $600 "stimulus cheque" sent to American taxpayers will be more - much, much more - than paid for, by higher borrowing costs.

Where are the forthright Cassandras on this side of the Atlantic? Are they silent because nobody here believes in our country?

The "little hand-mill"

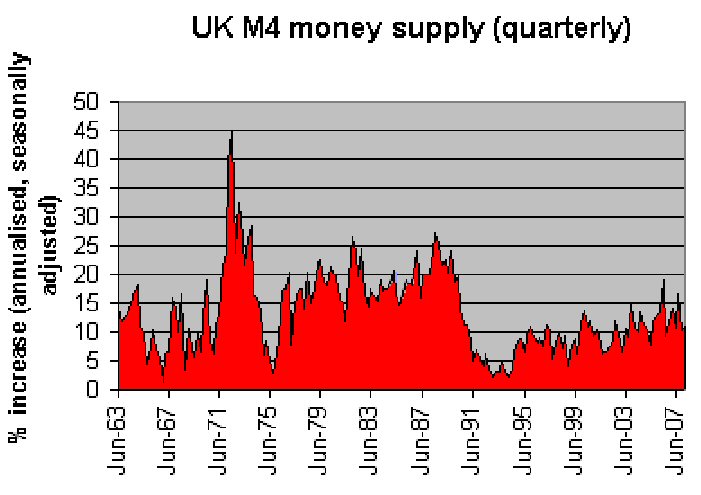

Official figures going back to 1963 show that bank lending has NEVER stopped increasing.

Official figures going back to 1963 show that bank lending has NEVER stopped increasing.Lowest: 1.1% annualised, for the quarter ending 31 December 1966.

Highest: 44.9% annualised, for the quarter ending 30 June 1972.

Median: 11.9%

Mean: 13.45%

Is it my imagination, or does the graph spike regularly before stockmarket crashes and recessions?

Original BoE data here.

In the late 60s, my school magazine carried a major bank's advert, for 16-year-old school leavers to join them. I aimed at a degree instead. Perhaps I'd have chosen differently if the ad had read "39 thieves looking to recruit trainee".

Do recessions lead to inflation?

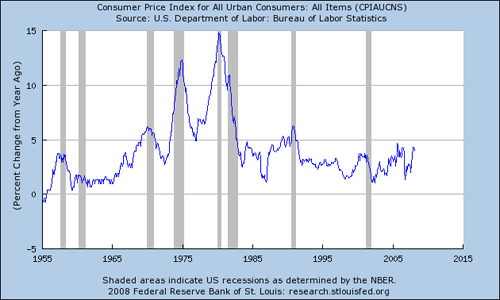

However, this picture suggests to me that recessions follow periods of higher inflation, and maybe where that inflation continues during the recession, it could be put down to a sort of residual momentum. Why should prices fall at precisely the moment the NBER says a recession has started? Even a cut flower will maintain its bloom for a while.

However, this picture suggests to me that recessions follow periods of higher inflation, and maybe where that inflation continues during the recession, it could be put down to a sort of residual momentum. Why should prices fall at precisely the moment the NBER says a recession has started? Even a cut flower will maintain its bloom for a while.

On the other hand, it seems clear from the above graph that prices do generally seem to fall after a recession. Perhaps this is because of the recently reinforced lesson about thrift, so people become less keen to spend too much on stuff they don't need.

But it's also possible that the recession has cleansed certain inefficiencies in the use of capital - businesses that should have folded faster - and as that capital gets better employed elsewhere, it does its work of improving productivity.

Which it needs to, when people have become more cost-conscious. I recall reading about an American who found a way to sell dresses for a dollar in the Great Depression - he used a machine to stamp out the outline of 100 at a time, so only the machine sewing was needed, not the measuring and cutting. So it was still possible to buy a dress for your sweetheart when money was tight.

But the little hand-mill of monetary inflation continues to grind...