A letter to the Spectator magazine, emailed to them today:

Sir: Your editorial (“People Power”, 20 February) welcomes Conservative proposals to extend consumer choice in schools and hospitals, and I hope this will open a wider debate about these imperfect and possibly outdated reifications of learning and health. For example, might we see less bureaucratic resistance to, and more financial support for home education?

But if the Conservatives have rediscovered their appetite for freedom and democracy, why, as Greece, fons et origo of those principles, lies tormented on the Procrustean metanarrative of the EU, are we denied a voice in the ultimate political question, that of national self-determination? Absent a referendum on membership of the Romantic and revolutionary project, we shall be limited-list libertarians, like council house dwellers selecting the hue of their front doors from officially-compiled colour charts.

Are we to be consulted, or must we refuse to vote at all in the coming General Election?

*** FUTURE POSTS WILL ALSO APPEAR AT 'NOW AND NEXT' : https://rolfnorfolk.substack.com

Showing posts with label The Spectator. Show all posts

Showing posts with label The Spectator. Show all posts

Saturday, February 20, 2010

Sunday, June 28, 2009

Another letter to The Spectator

Sir:

Irwin Stelzer (“No more consensus: this time there is a choice”) holds up Ronald Reagan as a model of a Conservative working for the ordinary voter. He could hardly have chosen a worse exemplar.

From 1947 to 1981 (the year in which Jimmy Carter left, and the Great Communicator took office), US public debt outstanding had fluctuated between $2 – 2.5 trillion (inflation-adjusted to 2009 dollars). Carter ended his Presidency with the debt no worse than it had been when he began. Under Reagan, the debt doubled in real terms (average 9.7% p.a. increase). Bush senior continued this trend (7.3% p.a.); the next two terms under Clinton showed a significant slowing (1.8% p.a.); but Bush junior picked up the pace again (6.3% p.a.) America now has $11.4 trillion public debt around its neck, approximately 5 times the equivalent in 1980, when Reagan asked voters, “Are you better off than you were four years ago?”

Well, how much better-off is Joe Average now? In the latest issue of Harvard Business Review, Gary Pisano and Willy Shih conclude that “average real weekly wages have essentially remained flat since 1980.” Instead, the “trickle-down effect” has turned out to be a torrent for the upper stratum only: in a 2006 speech reviewing hourly wage rate increases from 1973 – 2005, the economist Janet Yellen, of the Federal Reserve Bank of San Francisco, said “... the growth was heavily concentrated at the very tip of the top, that is, the top 1 percent”. The rest played catch-up by taking on extra personal debt: an investment analyst quoted in The Economist (22 January 2009) says “... the share of household and consumer debt alone went up from 100% of GDP in 1980 to 173% today, equivalent to around $6 trillion of extra borrowing.” Naturally, this process was much to the advantage of bankers, brokers and others in the top 1%.

In short, America has been pretty nearly busted by and for its elite. So much for the party of smaller government; so much for supporting the core Conservative, hard-working average wage-earner; not so much clear blue water, as a tide of red ink. One can only hope that the next British Conservative government, if there is one, will seek not to emulate Reagan and the Bushes.

Yours,

Irwin Stelzer (“No more consensus: this time there is a choice”) holds up Ronald Reagan as a model of a Conservative working for the ordinary voter. He could hardly have chosen a worse exemplar.

From 1947 to 1981 (the year in which Jimmy Carter left, and the Great Communicator took office), US public debt outstanding had fluctuated between $2 – 2.5 trillion (inflation-adjusted to 2009 dollars). Carter ended his Presidency with the debt no worse than it had been when he began. Under Reagan, the debt doubled in real terms (average 9.7% p.a. increase). Bush senior continued this trend (7.3% p.a.); the next two terms under Clinton showed a significant slowing (1.8% p.a.); but Bush junior picked up the pace again (6.3% p.a.) America now has $11.4 trillion public debt around its neck, approximately 5 times the equivalent in 1980, when Reagan asked voters, “Are you better off than you were four years ago?”

Well, how much better-off is Joe Average now? In the latest issue of Harvard Business Review, Gary Pisano and Willy Shih conclude that “average real weekly wages have essentially remained flat since 1980.” Instead, the “trickle-down effect” has turned out to be a torrent for the upper stratum only: in a 2006 speech reviewing hourly wage rate increases from 1973 – 2005, the economist Janet Yellen, of the Federal Reserve Bank of San Francisco, said “... the growth was heavily concentrated at the very tip of the top, that is, the top 1 percent”. The rest played catch-up by taking on extra personal debt: an investment analyst quoted in The Economist (22 January 2009) says “... the share of household and consumer debt alone went up from 100% of GDP in 1980 to 173% today, equivalent to around $6 trillion of extra borrowing.” Naturally, this process was much to the advantage of bankers, brokers and others in the top 1%.

In short, America has been pretty nearly busted by and for its elite. So much for the party of smaller government; so much for supporting the core Conservative, hard-working average wage-earner; not so much clear blue water, as a tide of red ink. One can only hope that the next British Conservative government, if there is one, will seek not to emulate Reagan and the Bushes.

Yours,

Sunday, March 29, 2009

Horrifying budget

Fraser Nelson in the Spectator:

To comprehend the scale of the sickening task awaiting George Osborne if he becomes chancellor, consider the following. If he were to raise VAT to 25 per cent, double corporation tax, close the Foreign Office, cancel all international aid, disband the army and the police, release all prisoners, close every school and abolish unemployment benefit he would still be unable to close the gulf between what the UK government spends and what it raises in taxes.

Where does all the money go? How can we get out of this in one piece?

To comprehend the scale of the sickening task awaiting George Osborne if he becomes chancellor, consider the following. If he were to raise VAT to 25 per cent, double corporation tax, close the Foreign Office, cancel all international aid, disband the army and the police, release all prisoners, close every school and abolish unemployment benefit he would still be unable to close the gulf between what the UK government spends and what it raises in taxes.

Where does all the money go? How can we get out of this in one piece?

Thursday, February 26, 2009

Still a bear, for now

A letter to the Spectator (unpublished), posted here on 2nd November 2008. We seem to be edging towards the "unsurprising", though the market may give a leap of denial before then:

Sir:

Your leader (“Riders On The Storm”, 1 November) suggests that current investor sentiment is “excessively negative”. That depends upon one’s historical perspective, in both directions.

A reversion to the mean (over the last generation) for UK house prices would be some 3.5 times household income, which on 2007 figures would imply average valuations around £120,000. Turning to shares, the progress of the Dow over the past 80 years (adjusted for consumer prices) indicates that a return to 6,000 points should be unsurprising, and a low of 4,000 not impossible.

But in addition to the business cycle and recurrent bubbles, there are deep linear changes at work. While maintaining the Western consumer in his fantasy of idle wealth, the East has been building up its human and physical industrial resources. We are focussing on the present recession, but not what the world will look like afterwards. When Asia has sufficiently developed its domestic demand, it will lose its enthusiasm for US Treasury debt, and the credit markets will tear at our economies with higher interest rates. Already, the search is well under way for an alternative to the US dollar as a world trading currency; and foreign investors, sovereign wealth funds and oil-rich governments are building up holdings in our bellwether businesses (e.g. Barclays Bank), thus converting imbalance into equity and exporting our future dividends.

Besides, the Dow and FTSE companies derive an increasing proportion of their income from abroad, so stock indices no longer reflect national prosperity. Real wages have stalled, and seem set to decline against a background of rising inflation and global competition; this, plus an interest rate correction, might strengthen the downward trend for house prices.

In short, successive governments have failed to repair our economic structure, and bear market rallies notwithstanding, I think we must eventually recalibrate our measures of normality.

Sir:

Your leader (“Riders On The Storm”, 1 November) suggests that current investor sentiment is “excessively negative”. That depends upon one’s historical perspective, in both directions.

A reversion to the mean (over the last generation) for UK house prices would be some 3.5 times household income, which on 2007 figures would imply average valuations around £120,000. Turning to shares, the progress of the Dow over the past 80 years (adjusted for consumer prices) indicates that a return to 6,000 points should be unsurprising, and a low of 4,000 not impossible.

But in addition to the business cycle and recurrent bubbles, there are deep linear changes at work. While maintaining the Western consumer in his fantasy of idle wealth, the East has been building up its human and physical industrial resources. We are focussing on the present recession, but not what the world will look like afterwards. When Asia has sufficiently developed its domestic demand, it will lose its enthusiasm for US Treasury debt, and the credit markets will tear at our economies with higher interest rates. Already, the search is well under way for an alternative to the US dollar as a world trading currency; and foreign investors, sovereign wealth funds and oil-rich governments are building up holdings in our bellwether businesses (e.g. Barclays Bank), thus converting imbalance into equity and exporting our future dividends.

Besides, the Dow and FTSE companies derive an increasing proportion of their income from abroad, so stock indices no longer reflect national prosperity. Real wages have stalled, and seem set to decline against a background of rising inflation and global competition; this, plus an interest rate correction, might strengthen the downward trend for house prices.

In short, successive governments have failed to repair our economic structure, and bear market rallies notwithstanding, I think we must eventually recalibrate our measures of normality.

Saturday, December 06, 2008

An expert writes

The words...

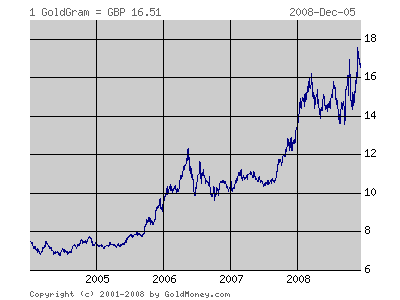

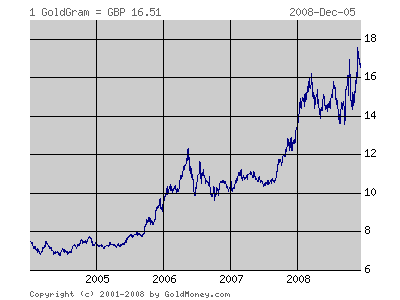

In truth, gold has been a poor investment for a long time...

Other safe havens have done much better... Government bonds... Swiss franc...

Gold rises and falls with oil, copper and wheat, and all the other things that get turned into stuff in factories. It is still a useful metal. But it is not money — and after its failure to rally in this crisis, even the most dogmatic gold bug may well have to admit that.

(Matthew Lynn in The Spectator)

The picture...

Saturday, November 08, 2008

A brilliant idea - Kiva microfinance

Let's think about people to whom $25 would make - is making - a difference. Rory Sutherland's column in The Spectator this week is about Kiva, a project that lends small sums to individuals and groups around the world, mostly to set up or develop little businesses.

They repay from their increased production, you get to re-lend to more people. Really, it's a way that the poor but proud can help each other, using your finance to grease the wheels.

Having read Sutherland, I've just joined, and I really feel good about it. Why don't you?

They repay from their increased production, you get to re-lend to more people. Really, it's a way that the poor but proud can help each other, using your finance to grease the wheels.

Having read Sutherland, I've just joined, and I really feel good about it. Why don't you?

Sunday, November 02, 2008

Dow 4,900 - sometime?

I'm still working on looking at the Dow in real (CPI-adjusted) terms. Meanwhile, note that in two previous cycles, the Dow dropped to a third of its former peak: from 15 to 5, from 30 to 10 (see red dots).

I'm still working on looking at the Dow in real (CPI-adjusted) terms. Meanwhile, note that in two previous cycles, the Dow dropped to a third of its former peak: from 15 to 5, from 30 to 10 (see red dots).If history repeats itself, then in real terms the Dow would again lose two-thirds of its value, from 66 to 22, which considering last autumn's peak would imply an ultimate low (if it happened all at once, tomorrow) of about 4,900 points.

But in the previous cases, the process took years to complete, and I would expect it to be a long affair this time, too. The Dow may not hit this 4,900 low in nominal terms.

Continuing this theme, may I draw your attention to the letter I emailed to The Spectator today?

Yet another letter to the Spectator

Sir:

Your leader (“Riders On The Storm”, 1 November) suggests that current investor sentiment is “excessively negative”. That depends upon one’s historical perspective, in both directions.

A reversion to the mean (over the last generation) for UK house prices would be some 3.5 times household income, which on 2007 figures would imply average valuations around £120,000. Turning to shares, the progress of the Dow over the past 80 years (adjusted for consumer prices) indicates that a return to 6,000 points should be unsurprising, and a low of 4,000 not impossible.

But in addition to the business cycle and recurrent bubbles, there are deep linear changes at work. While maintaining the Western consumer in his fantasy of idle wealth, the East has been building up its human and physical industrial resources. We are focussing on the present recession, but not what the world will look like afterwards. When Asia has sufficiently developed its domestic demand, it will lose its enthusiasm for US Treasury debt, and the credit markets will tear at our economies with higher interest rates. Already, the search is well under way for an alternative to the US dollar as a world trading currency; and foreign investors, sovereign wealth funds and oil-rich governments are building up holdings in our bellwether businesses (e.g. Barclays Bank), thus converting imbalance into equity and exporting our future dividends.

Besides, the Dow and FTSE companies derive an increasing proportion of their income from abroad, so stock indices no longer reflect national prosperity. Real wages have stalled, and seem set to decline against a background of rising inflation and global competition; this, plus an interest rate correction, might strengthen the downward trend for house prices.

In short, successive governments have failed to repair our economic structure, and bear market rallies notwithstanding, I think we must eventually recalibrate our measures of normality.

Your leader (“Riders On The Storm”, 1 November) suggests that current investor sentiment is “excessively negative”. That depends upon one’s historical perspective, in both directions.

A reversion to the mean (over the last generation) for UK house prices would be some 3.5 times household income, which on 2007 figures would imply average valuations around £120,000. Turning to shares, the progress of the Dow over the past 80 years (adjusted for consumer prices) indicates that a return to 6,000 points should be unsurprising, and a low of 4,000 not impossible.

But in addition to the business cycle and recurrent bubbles, there are deep linear changes at work. While maintaining the Western consumer in his fantasy of idle wealth, the East has been building up its human and physical industrial resources. We are focussing on the present recession, but not what the world will look like afterwards. When Asia has sufficiently developed its domestic demand, it will lose its enthusiasm for US Treasury debt, and the credit markets will tear at our economies with higher interest rates. Already, the search is well under way for an alternative to the US dollar as a world trading currency; and foreign investors, sovereign wealth funds and oil-rich governments are building up holdings in our bellwether businesses (e.g. Barclays Bank), thus converting imbalance into equity and exporting our future dividends.

Besides, the Dow and FTSE companies derive an increasing proportion of their income from abroad, so stock indices no longer reflect national prosperity. Real wages have stalled, and seem set to decline against a background of rising inflation and global competition; this, plus an interest rate correction, might strengthen the downward trend for house prices.

In short, successive governments have failed to repair our economic structure, and bear market rallies notwithstanding, I think we must eventually recalibrate our measures of normality.

Friday, September 26, 2008

Spectator letter is published

The Spectator magazine has published my recent letter; heavily edited, but at least it was the first in the list, so that's some sort of recognition:

"Storing up more trouble

Sir:

Your leading article (20 September) calls for a ‘kick up the backside’ to the banking industry. That kick should be aimed elsewhere. The British and American governments have not merely permitted this crisis to happen, but positively created it by a deliberate relaxation of monetary controls. Worse still, they have now decided that instead of destroying excess credit by asset deflation, bankruptcies and share collapses, the monetary inflation is to be consolidated by absorption of bad debt into the public finances.

I don’t see how this can end well. Some commentators are already saying that, if passed unaltered, the proposed American financial legislation could, once properly understood, trigger a major crash in US financial shares, possibly before this letter is published.

I think The Spectator and its economically savvy readers should put on fresh pairs of winkle-pickers, and gather in Whitehall and Washington for some kicking practice."

"Storing up more trouble

Sir:

Your leading article (20 September) calls for a ‘kick up the backside’ to the banking industry. That kick should be aimed elsewhere. The British and American governments have not merely permitted this crisis to happen, but positively created it by a deliberate relaxation of monetary controls. Worse still, they have now decided that instead of destroying excess credit by asset deflation, bankruptcies and share collapses, the monetary inflation is to be consolidated by absorption of bad debt into the public finances.

I don’t see how this can end well. Some commentators are already saying that, if passed unaltered, the proposed American financial legislation could, once properly understood, trigger a major crash in US financial shares, possibly before this letter is published.

I think The Spectator and its economically savvy readers should put on fresh pairs of winkle-pickers, and gather in Whitehall and Washington for some kicking practice."

Sunday, September 21, 2008

Another letter to the Spectator

Let's see if they bin this one: (n.b. I've made a few alterations in the hour since posting)

Sir;

Your leader (“Long live capitalism”, 20 September) calls for a “kick up the backside” to the banking industry. That kick should be aimed elsewhere.

Light regulation and free markets, which the Spectator advocates, depend on the self-regulating properties of a sound money system. But like many others, the British government has long used the fiat nature of its currency-cum-credit to solve temporary problems and create permanent ones. The long-term real growth of GDP is said to average 2.5% annually, yet since 1963 the Bank of England’s own statistics show that the M4 money supply has grown by about 13.5% p.a. Over the same period, RPI has averaged about 6.5% p.a. At this rate, the banks will ultimately own everything.

For the first 5 years of the New Labour administration, M4 growth was, not exactly prudently, but less recklessly, restricted to around 8.25% p.a. However, by 2003 the FTSE had halved from its 2000 peak, and there was gloomy talk of recession; and over the next five years M4 suddenly averaged nearly 14%. Then house prices doubled; hinc illae lachrymae.

How did this happen? The system of fractional reserve lending means that banks can loan out a multiple of what they retain in their vaults. State regulators set the rules for the required marginal reserves, and when reserve requirements are halved, lending can double, and usually will; like Labradors, bankers will have whatever is put on their plate.

Knowing this tendency, the British and American governments have not merely permitted this crisis to happen, but positively created it by a deliberate relaxation of monetary controls. Worse still, they have now decided that instead of destroying excess credit by asset deflation, bankruptcies and share collapses, the monetary inflation is to be consolidated by absorption of bad debt into the public finances.

I don’t see how this can end well. Some commentators are already saying that, if passed unaltered, the proposed American financial legislation could, once properly understood, trigger a major crash in US financial shares, possibly before this letter is published.

I think the Spectator and its economically savvy readers should put on fresh pairs of winkle-pickers, and gather in Whitehall and Washington for some kicking practice.

Yours faithfully

Sir;

Your leader (“Long live capitalism”, 20 September) calls for a “kick up the backside” to the banking industry. That kick should be aimed elsewhere.

Light regulation and free markets, which the Spectator advocates, depend on the self-regulating properties of a sound money system. But like many others, the British government has long used the fiat nature of its currency-cum-credit to solve temporary problems and create permanent ones. The long-term real growth of GDP is said to average 2.5% annually, yet since 1963 the Bank of England’s own statistics show that the M4 money supply has grown by about 13.5% p.a. Over the same period, RPI has averaged about 6.5% p.a. At this rate, the banks will ultimately own everything.

For the first 5 years of the New Labour administration, M4 growth was, not exactly prudently, but less recklessly, restricted to around 8.25% p.a. However, by 2003 the FTSE had halved from its 2000 peak, and there was gloomy talk of recession; and over the next five years M4 suddenly averaged nearly 14%. Then house prices doubled; hinc illae lachrymae.

How did this happen? The system of fractional reserve lending means that banks can loan out a multiple of what they retain in their vaults. State regulators set the rules for the required marginal reserves, and when reserve requirements are halved, lending can double, and usually will; like Labradors, bankers will have whatever is put on their plate.

Knowing this tendency, the British and American governments have not merely permitted this crisis to happen, but positively created it by a deliberate relaxation of monetary controls. Worse still, they have now decided that instead of destroying excess credit by asset deflation, bankruptcies and share collapses, the monetary inflation is to be consolidated by absorption of bad debt into the public finances.

I don’t see how this can end well. Some commentators are already saying that, if passed unaltered, the proposed American financial legislation could, once properly understood, trigger a major crash in US financial shares, possibly before this letter is published.

I think the Spectator and its economically savvy readers should put on fresh pairs of winkle-pickers, and gather in Whitehall and Washington for some kicking practice.

Yours faithfully

Sunday, September 14, 2008

A letter to the Spectator

I am constitutionally a sceptic ( a term which, like "humanist", has been degraded to mean simply atheist, a sense I don't intend), but not being cocksure either way, I think civilised life depends on a benevolent forbearance that is being eroded by Puritans of all stripes.

I've submitted the following letter to the Speccie in response to this by Rod Liddle, but like as not it will not be published, so you may as well have a preview.

Sir:

In typically flippant manner, Rod Liddle (13 September) mocks the alleged stupidity and cowardice of would-be Islamic martyrs. It’s true that there is an adolescent power-seeking element: I was confronted by a serious-faced posse of 15-year-olds in a school corridor on 13 September 2001, and the spokesman said, “Sir, what happened on Tuesday: good, innit?” With that, leaving their kaffir teacher satisfyingly speechless, the delegation walked off.

But the self-appointed leader was far from stupid, as I knew: he could probably have got his inflatable A* in GCSE English a year early. And teenagers mind-manacled by a few simple ideas can be very brave, which is why armies everywhere have been glad to use them.

Moreover, this is not a Children’s Crusade, but a war of ideas. We had our own a generation ago: “Smash the System”, Ho Chi Minh’s lantern fizzog stencilled on Oxford college walls, etc. If Liddle wishes for an answer, it is to be found in the article immediately after his own, where Harry Mount quotes Philip Larkin: “A hunger ... to be more serious.” Wiffy-woffy liberal democracy is under attack from both domestic Left and alien religious Right. The politico-religious settlement that was the Church of England is crumbling.

In a Gramscian campaign, the means of cultural transmission (the educational curriculum, the broadcast media, even some of the clergy) have been captured and turned against what used to unite us. Recently, we have gone from the martyrs’ certainty of Latimer, Ridley and Cranmer to the confusing fast-talk of Bishop David Jenkins, the slapstick clerical comedy of Dawn French and the nihilistic assertiveness of that scruffy peacock Richard Dawkins. When, a year or two ago, the BBC transmitted “Any Questions?” from a church at Christmas, the panel inevitably included a smug young atheist exhorting the faithful to “embrace the dark.”

The real Delusion is that we can cut down the ancient forests of our history and expect a lovely garden to spring up among the stumps. As Robert Bolt’s More says, “Do you really think you could stand upright in the winds that would blow then?” The seriousness for which people hunger is not found in the drunken debauchery alternately promoted and lamented in Parliament and the newspapers, and that which is being destroyed will find its replacement.

I've submitted the following letter to the Speccie in response to this by Rod Liddle, but like as not it will not be published, so you may as well have a preview.

Sir:

In typically flippant manner, Rod Liddle (13 September) mocks the alleged stupidity and cowardice of would-be Islamic martyrs. It’s true that there is an adolescent power-seeking element: I was confronted by a serious-faced posse of 15-year-olds in a school corridor on 13 September 2001, and the spokesman said, “Sir, what happened on Tuesday: good, innit?” With that, leaving their kaffir teacher satisfyingly speechless, the delegation walked off.

But the self-appointed leader was far from stupid, as I knew: he could probably have got his inflatable A* in GCSE English a year early. And teenagers mind-manacled by a few simple ideas can be very brave, which is why armies everywhere have been glad to use them.

Moreover, this is not a Children’s Crusade, but a war of ideas. We had our own a generation ago: “Smash the System”, Ho Chi Minh’s lantern fizzog stencilled on Oxford college walls, etc. If Liddle wishes for an answer, it is to be found in the article immediately after his own, where Harry Mount quotes Philip Larkin: “A hunger ... to be more serious.” Wiffy-woffy liberal democracy is under attack from both domestic Left and alien religious Right. The politico-religious settlement that was the Church of England is crumbling.

In a Gramscian campaign, the means of cultural transmission (the educational curriculum, the broadcast media, even some of the clergy) have been captured and turned against what used to unite us. Recently, we have gone from the martyrs’ certainty of Latimer, Ridley and Cranmer to the confusing fast-talk of Bishop David Jenkins, the slapstick clerical comedy of Dawn French and the nihilistic assertiveness of that scruffy peacock Richard Dawkins. When, a year or two ago, the BBC transmitted “Any Questions?” from a church at Christmas, the panel inevitably included a smug young atheist exhorting the faithful to “embrace the dark.”

The real Delusion is that we can cut down the ancient forests of our history and expect a lovely garden to spring up among the stumps. As Robert Bolt’s More says, “Do you really think you could stand upright in the winds that would blow then?” The seriousness for which people hunger is not found in the drunken debauchery alternately promoted and lamented in Parliament and the newspapers, and that which is being destroyed will find its replacement.

Monday, June 30, 2008

A defence of blogging

In early times, learning was only to be had by digging and mining; it is now the circulating medium. Men may become learned in many ways besides the means of erudite courses of instruction: that is learning which enables a writer to inform his readers of matters applicable to the purposes of either profit or pleasure, of which they were not previously aware. In this sense, many are learned who do not suspect themselves in possession of this envied distinction. A prejudice lingers, however, in favour of that description of learning gained by hard study over tall books, and under the dim light of the lamp. But this is only the theory: in practice, men appreciate the living learning only which cheers the evening of leisure, or guides the daily labour - enlightens the professions, or instructs the statesman.

From "The Spectator" magazine, inaugural issue, July 5, 1828.

Yet how swiftly do some other publications forget their humble origins, which have subsequently attained eminent status. "Private Eye" lampoons the "online community" in its column "From The Message Boards"; but in 1961, there were its founders Christopher Booker and Willie Rushton, using typewriter, Letraset, hand-drawn cartoons, scissors and glue (in Willie's mother's flat, I seem to remember) to compose their witty and scurrilous magazine; and the new technology of photo-litho offset to print it. How is this different from the homeworkers of the blogosphere, and the use of the new capabilities of the Internet? Was not Private Eye the original blogpaper?

From "The Spectator" magazine, inaugural issue, July 5, 1828.

Yet how swiftly do some other publications forget their humble origins, which have subsequently attained eminent status. "Private Eye" lampoons the "online community" in its column "From The Message Boards"; but in 1961, there were its founders Christopher Booker and Willie Rushton, using typewriter, Letraset, hand-drawn cartoons, scissors and glue (in Willie's mother's flat, I seem to remember) to compose their witty and scurrilous magazine; and the new technology of photo-litho offset to print it. How is this different from the homeworkers of the blogosphere, and the use of the new capabilities of the Internet? Was not Private Eye the original blogpaper?

Subscribe to:

Posts (Atom)