How much debt does the USA have, compared to its income? According to Ned Davis Research, the previous all-time high was in the Depression of the 30s (265%); NDR's latest estimate is 350%, The Mogambo Guru reports.

So, inflation or deflation? The Mogambo Guru rants that only inflation (which he hates) can save us now. But in the first link above, Louis P. Stanasolovich comments:

High debt levels also have another side effect: disinflation. Because consumers and businesses have limited spending, they must retrench once they reach their saturation points. When the demand for goods and services diminishes due to the over-extension of credit, the result is disinflation.

In other words, we will have to live poorer - no matter what the currency does. We see in Zimbabwe that you can have billions and it won't buy you a square meal. What inflation can do, is disguise the problems for a while (as it did post-2000) - until the system breaks down completely. Who has the public spirit and grit to stop the charade now?

By the way (since The Mogambo Guru loves gold)... Krugerrand = going out to get more champagne.

*** FUTURE POSTS WILL ALSO APPEAR AT 'NOW AND NEXT' : https://rolfnorfolk.substack.com

Thursday, July 31, 2008

Friday, July 25, 2008

Inflation, deflation, the world economy and freedom

This article by Matthew Beller on the Mises website tries to show how the US government can't "print its way out" of the present crisis.

The Federal Reserve controls the "monetary base" of physical currency and bank deposits, which represent only 15% of the money supply; the rest is bank lending. Currently, the banks are in a fright, so they are reducing credit, on which the economy depends. But if the Federal Reserve increases the monetary base, the banks' ability to multiply their deposits could lead to hyperinflation and the destruction of the dollar altogether. Hence the attempts to maintain confidence in the banking system instead, even if that means expensive financial support.

This isn't enough for the monetarists. They say the lending in the recent boom went on consumer spending, which encouraged producers to make too much of the wrong stuff and so the economy developed in the wrong way. The econo-Puritans say we should accept deflation because, although temporarily painful, it will rebalance the economy for a more sustainable long-term future.

However, nobody likes nasty medicine, so a political question is whether democracies will allow politicians to take timely corrective action. Past history suggests that we'll only vote for the treatment when we're half-dead, and even then, we'll curse the doctor afterwards.

My feeling is that this tendency to delay means that underneath the business cycle is a fatal linear trend, moving wealth and power to less democratic countries. When the world economy recovers, it may be on very different terms: for although (e.g.) China may suffer a setback as the Western consumer reduces spending, Chinese industrial capacity has been growing over recent years - not only the factories and tools, but equally importantly the skills base. At the upturn, the East will be well-placed to cater for reviving demand, while the West struggles to supply appropriately-skilled labour, and tries to buy back some of the industrial materials it had previously exported. And as the East industrialises, it will generate locally a greater proportion of world demand.

I cannot see how we can avoid becoming poorer, on average, than we have been in past decades, even if an elite in our society grows richer and more powerful (a phenomenon associated with more impoverished economies). We cannot rely on high-end production: China will address its quality issues, as Japan did in the 1950s. Nor can we be complacent about intellectual property rights, in a world where might makes right.

But China itself has deep problems - an growing and ageing population; an increasingly unbalanced demographic structure, thanks to attempts to limit family size; pollution; water shortgages; declining quality of farm land. The Chinese leadership faces a long-term challenge in dealing with unsatisfiable domestic expectations, which will tend to make it intransigent in its relations with foreign powers. The East-West contest may become characterized by desperation on both sides.

And so democracy in the West will come under pressure. In difficult times, people are thrown back on a network of social relationships and mutual expectations, but sudden, unreal access of wealth has tempted us to put our faith in the amassing of cash, and/or government intervention, to the detriment of agreed internal social control and support systems. When the system enters its failure phase, which Fischer ("The Great Wave") thinks may be starting, the social threads begin to snap: inflation, crime, family breakdown, war. The reification of the ties that bind us together tempts our government to maintain the social order through externalised means of surveillance and enforcement. Ultimately, the mismanagement of national budgets is a freedom issue.

The Federal Reserve controls the "monetary base" of physical currency and bank deposits, which represent only 15% of the money supply; the rest is bank lending. Currently, the banks are in a fright, so they are reducing credit, on which the economy depends. But if the Federal Reserve increases the monetary base, the banks' ability to multiply their deposits could lead to hyperinflation and the destruction of the dollar altogether. Hence the attempts to maintain confidence in the banking system instead, even if that means expensive financial support.

This isn't enough for the monetarists. They say the lending in the recent boom went on consumer spending, which encouraged producers to make too much of the wrong stuff and so the economy developed in the wrong way. The econo-Puritans say we should accept deflation because, although temporarily painful, it will rebalance the economy for a more sustainable long-term future.

However, nobody likes nasty medicine, so a political question is whether democracies will allow politicians to take timely corrective action. Past history suggests that we'll only vote for the treatment when we're half-dead, and even then, we'll curse the doctor afterwards.

My feeling is that this tendency to delay means that underneath the business cycle is a fatal linear trend, moving wealth and power to less democratic countries. When the world economy recovers, it may be on very different terms: for although (e.g.) China may suffer a setback as the Western consumer reduces spending, Chinese industrial capacity has been growing over recent years - not only the factories and tools, but equally importantly the skills base. At the upturn, the East will be well-placed to cater for reviving demand, while the West struggles to supply appropriately-skilled labour, and tries to buy back some of the industrial materials it had previously exported. And as the East industrialises, it will generate locally a greater proportion of world demand.

I cannot see how we can avoid becoming poorer, on average, than we have been in past decades, even if an elite in our society grows richer and more powerful (a phenomenon associated with more impoverished economies). We cannot rely on high-end production: China will address its quality issues, as Japan did in the 1950s. Nor can we be complacent about intellectual property rights, in a world where might makes right.

But China itself has deep problems - an growing and ageing population; an increasingly unbalanced demographic structure, thanks to attempts to limit family size; pollution; water shortgages; declining quality of farm land. The Chinese leadership faces a long-term challenge in dealing with unsatisfiable domestic expectations, which will tend to make it intransigent in its relations with foreign powers. The East-West contest may become characterized by desperation on both sides.

And so democracy in the West will come under pressure. In difficult times, people are thrown back on a network of social relationships and mutual expectations, but sudden, unreal access of wealth has tempted us to put our faith in the amassing of cash, and/or government intervention, to the detriment of agreed internal social control and support systems. When the system enters its failure phase, which Fischer ("The Great Wave") thinks may be starting, the social threads begin to snap: inflation, crime, family breakdown, war. The reification of the ties that bind us together tempts our government to maintain the social order through externalised means of surveillance and enforcement. Ultimately, the mismanagement of national budgets is a freedom issue.

Banks: the legal recriminations begin.

I wondered a while ago where bankers would flee when the reckoning came. Looks like the lawsuits are starting already.

Thursday, July 24, 2008

For the gold bugs

"Jesse" does a chart suggesting the gold price could drop to $875 before taking off for $1,200 and upwards.

China shakes the steel world

Shen Wenrong, the billionaire who bought Dortmund's Phoenix steel plant and moved it to the Pearl River, is increasing his hold on the privately-owned sector of the Chinese steel industry, as reported in SteelGuru here.

Readers of James Kynge's "China Shakes the World" will recall that Wenrong acquired Phoenix in 2004 partly in order to get into production fast, but also because, having bought it at scrap valuation during the last steel recession, he would not be encumbered with the debts that would wipe out his rivals in the next one.

Which means that he's looking beyond the next recession. And when the recovery comes, where will the West's capacity be found? Those who say that the East's fortunes are bound up with those of the West, had better get new spectacles to correct their short-sightedness.

Readers of James Kynge's "China Shakes the World" will recall that Wenrong acquired Phoenix in 2004 partly in order to get into production fast, but also because, having bought it at scrap valuation during the last steel recession, he would not be encumbered with the debts that would wipe out his rivals in the next one.

Which means that he's looking beyond the next recession. And when the recovery comes, where will the West's capacity be found? Those who say that the East's fortunes are bound up with those of the West, had better get new spectacles to correct their short-sightedness.

GSE losses "only $25 billion"

Bloomberg reports on the bailout plan. Only $25 billion? Phew - a couple of Senators were thinking maybe $1 trillion, as The Motley Fool's TMFSinchiruna points out.

Could I please have "only" 1% of the lower figure for my modest needs? You won't miss it - after all, look at what you haven't missed so far. I'd even write you a specially nice letter of thanks.

Could I please have "only" 1% of the lower figure for my modest needs? You won't miss it - after all, look at what you haven't missed so far. I'd even write you a specially nice letter of thanks.

Mugabe "fighting extradition to the Hague"

I presume that in the wake of his arrest and ongoing extradition battle, the case of a certain Serbian alleged war criminal is sub judice, so I have edited down and altered names, facts, numbers and places in the following Press Association article, using alternatives plucked at random.

Mugabe fights crimes extradition

1 day ago

Former Zimbabwean leader Robert Mugabe is battling extradition from Zimbabwe to the Netherlands, where he faces trial for genocide.

Mugabe's lawyers have been given three days to appeal against the extradition ruling by a Zimbabwean judge.

If the extradition goes ahead he will stand trial at the International Criminal Tribunal in The Hague on war crimes charges - including masterminding the massacre of thousands of Ndebele in Matabeleland during the liberation war of the 1980s.

Meanwhile, the arrest of the former Zimbabwean leader could help pave the way for Zimbabwe finally to join the European Union, Foreign Secretary David Miliband signalled.

Attending a meeting of the EU foreign ministers in Brussels, Mr Miliband said that the actions of the Zimbabwean government "bodes very well for long-term relations".

Mugabe was arrested while travelling on a bus in Harare, Zimbabwe. The one-time education lecturer had been practising as a tutor in legal studies during his period as a fugitive from international justice.

The Financial Times reports British and US intelligence helped trap Mugabe. The newspaper says they co-operated with Zimbabwean intelligence services, using both signals and human intelligence to track him down.

Mugabe's lawyer said his client was in good spirits but was not co-operating with police.

The hunt for Mugabe's right-hand man, Emmerson Mnangagwa, continues.

Now aged 61, his whereabouts are not known, but is believed that he could be hiding in Zimbabwe with the help of hardliners in the police and military and Mashona loyalists.

Mugabe fights crimes extradition

1 day ago

Former Zimbabwean leader Robert Mugabe is battling extradition from Zimbabwe to the Netherlands, where he faces trial for genocide.

Mugabe's lawyers have been given three days to appeal against the extradition ruling by a Zimbabwean judge.

If the extradition goes ahead he will stand trial at the International Criminal Tribunal in The Hague on war crimes charges - including masterminding the massacre of thousands of Ndebele in Matabeleland during the liberation war of the 1980s.

Meanwhile, the arrest of the former Zimbabwean leader could help pave the way for Zimbabwe finally to join the European Union, Foreign Secretary David Miliband signalled.

Attending a meeting of the EU foreign ministers in Brussels, Mr Miliband said that the actions of the Zimbabwean government "bodes very well for long-term relations".

Mugabe was arrested while travelling on a bus in Harare, Zimbabwe. The one-time education lecturer had been practising as a tutor in legal studies during his period as a fugitive from international justice.

The Financial Times reports British and US intelligence helped trap Mugabe. The newspaper says they co-operated with Zimbabwean intelligence services, using both signals and human intelligence to track him down.

Mugabe's lawyer said his client was in good spirits but was not co-operating with police.

The hunt for Mugabe's right-hand man, Emmerson Mnangagwa, continues.

Now aged 61, his whereabouts are not known, but is believed that he could be hiding in Zimbabwe with the help of hardliners in the police and military and Mashona loyalists.

Wednesday, July 23, 2008

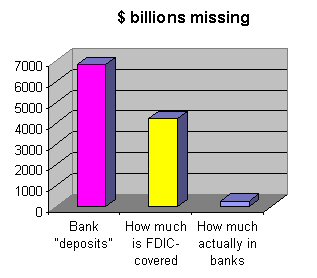

Mish: "The entire US banking system is insolvent."

Mish gives us a long list of bad news; the last item is, arguably, the worst:

Of the $6.84 Trillion in bank deposits, the total cash on hand at banks is a mere $273.7 Billion. Where is the rest of the loot? The answer is in off balance sheet SIVs, imploding commercial real estate deals, Alt-A liar loans, Fannie Mae and Freddie Mac bonds, toggle bonds where debt is amazingly paid back with more debt, and all sorts of other silly (and arguably fraudulent) financial wizardry schemes that have bank and brokerage firms leveraged at 30-1 or more. Those loans cannot be paid back.

What cannot be paid back will be defaulted on. If you did not know it before, you do now. The entire US banking system is insolvent.

Big rewards for corporate failure

Wikipedia reports that chief executive Angelo Mozilo cashed in over $400 million (about a third of it in 2006/7) in Countrywide Financial stock before the failing lender's purchase by Bank of America this month. Karl Denninger's latest dramatic video presentation says, in effect, that bankers looted the system for personal gain and are now trying to get the taxpayer to foot the bill.

Investment wise owl Christopher Fildes has long advocated that, if they expect a bonus when things go well, directors should pay a "malus" when the company suffers. The French already use a bonus/malus system as a stick-and-carrot for car drivers.

Maybe then I'd be more reconciled to gross inequalities of wealth.

Investment wise owl Christopher Fildes has long advocated that, if they expect a bonus when things go well, directors should pay a "malus" when the company suffers. The French already use a bonus/malus system as a stick-and-carrot for car drivers.

Maybe then I'd be more reconciled to gross inequalities of wealth.

New: UK private schools fully-funded by the State

A friend has just sent me this article, originally from The Economist (14 June 2008). It's about the private-school revolution in Sweden, which is now coming here (starting in Richmond).

I've often wondered what the education system does with all the money - £6,000 a head times 30 children (if you're an English or maths teacher) = £180,000, but the classroom teacher's standard pay and pension might only use £30k-£40k a year.

Here's the website for the Swedish outfit trying their luck with a couple of academies in Greater London.

I've often wondered what the education system does with all the money - £6,000 a head times 30 children (if you're an English or maths teacher) = £180,000, but the classroom teacher's standard pay and pension might only use £30k-£40k a year.

Here's the website for the Swedish outfit trying their luck with a couple of academies in Greater London.

In praise of Patrick O'Flynn

This wide-ranging article by the Daily Express' chief political commentator covers many aspects of the broad crisis that led me to start blogging. My interest is not money per se, but about the fate of our country, and here Patrick O'Flynn unrolls a map of our problems, including:

Spot on. But it's still tucked away on page 12 in yesterday's paper edition, well after Madeleine McCann and Amy Winehouse. This stuff should be hitting the front page all the time, because long after we've forgotten the celeb victims of today, we'll be counting the cost of our government's political and economic negligence and incompetence.

- The rise of the East

- The growing power of foreign authoritarian regimes

- The purchase of British enterprises by foreign sovereign wealth funds, and the consequent export of our future dividend income

- Increasing foreign-held UK public debt (again, more income exported)

- Our vulnerability to energy repricing, and inadequate energy security

- Inflation in food and fuel

- Our unbalanced national budget, what with the cost of unemployment, and rising costs in other social benefits such as the NHS

- Inefficiency in the public sector

- The UK's squandering of its North Sea oil opportunity (cf. Norway's £300 billion investment fund)

- British economic decline, and our deterioriating manufacturing base

Spot on. But it's still tucked away on page 12 in yesterday's paper edition, well after Madeleine McCann and Amy Winehouse. This stuff should be hitting the front page all the time, because long after we've forgotten the celeb victims of today, we'll be counting the cost of our government's political and economic negligence and incompetence.

Gold fever may return

Gold has been in the doldrums for a while, but we're now getting messages about inflation and if Fannie Mae and Freddie Mac are added to the liabilities of the US Government, we could be back in the paper-money world of pre-Revolutionary France as advised by the Scottish gambler, John Law.

The Mogambo Guru gives value, not just in comic entertainment, but also in his useful references. One of them is to Adrian Ash, who points out that gold is now worth less than 2% of world financial assets, whereas at times of "investor stress" (and as late as 1982) it has risen to 20-25%. It may be time to consider the argument for precious metals, not so much as investments as insurance against the severe loss of value of other assets.

The Mogambo Guru gives value, not just in comic entertainment, but also in his useful references. One of them is to Adrian Ash, who points out that gold is now worth less than 2% of world financial assets, whereas at times of "investor stress" (and as late as 1982) it has risen to 20-25%. It may be time to consider the argument for precious metals, not so much as investments as insurance against the severe loss of value of other assets.

The EU and Radavan Karadzic

(The archive footage included an infamously misleading shot of Bosnian Muslims behind barbed wire, hauntingly reminiscent of the Nazi concentration camps; both at the time and again now, it was not explained that it was the camera crew that was penned in. Still, dramatic truth and all that.)

Whatever the terrible crimes of this man, the decision by Serbia's new, pro-EU government to "lighten the troika" looks primarily motivated by the desire to re-establish trade and diplomatic links with "Europe." So to me, the real story is the continuing expansion of the new European Empire.

The Balkans are being knocked into shape, or so the empire-builders think. Kosova declared independence in February 2008 (in the teeth of an attempted legal challenge by Serbia) and has been recognised by the USA and many other countries. The 100,000 Serbs in Kosova make up only 5% of the new nation's population, and compared to the 10 million in Serbia itself they are, presumably, of little account politically there, also. Besides, of course, Kosovans are not wolves.

The Balkans are being knocked into shape, or so the empire-builders think. Kosova declared independence in February 2008 (in the teeth of an attempted legal challenge by Serbia) and has been recognised by the USA and many other countries. The 100,000 Serbs in Kosova make up only 5% of the new nation's population, and compared to the 10 million in Serbia itself they are, presumably, of little account politically there, also. Besides, of course, Kosovans are not wolves.

The Balkans are being knocked into shape, or so the empire-builders think. Kosova declared independence in February 2008 (in the teeth of an attempted legal challenge by Serbia) and has been recognised by the USA and many other countries. The 100,000 Serbs in Kosova make up only 5% of the new nation's population, and compared to the 10 million in Serbia itself they are, presumably, of little account politically there, also. Besides, of course, Kosovans are not wolves.

The Balkans are being knocked into shape, or so the empire-builders think. Kosova declared independence in February 2008 (in the teeth of an attempted legal challenge by Serbia) and has been recognised by the USA and many other countries. The 100,000 Serbs in Kosova make up only 5% of the new nation's population, and compared to the 10 million in Serbia itself they are, presumably, of little account politically there, also. Besides, of course, Kosovans are not wolves.But the question remains, how much more of Europe's former battlegrounds does the EU have the wealth and power to suborn, absorb and control? What will happen when its money runs low? Can its Babel-army sustain the territorial integrity of a hastily-constructed, ramshackle and heterogeneous empire? Will its gourmet diplomats and bibbed lawyers maintain law and reason under its young, yet complex and fuzzy legal and constitutional codes?

Tuesday, July 22, 2008

Whose country?

"Citizenship in this nation is is not a spectator sport," says Karl Denninger, as he tries to get more people to sign his petition to stop Fannie Mae and Freddie Mac being made vast burdens of the State.

I hope that is true for the USA, and I wish it were true here. Are we deluding ourselves when we talk of "our" Government?

I hope that is true for the USA, and I wish it were true here. Are we deluding ourselves when we talk of "our" Government?

Worrying signs

Knowing that debt creates extra money and so boosts inflation, The Mogambo Guru notes that the Chinese now have 1.58 billion credit cards! For some reason, TMG thinks we should look at gold and silver.

Karl Denninger points out that short-selling actually acts as a kind of price support in the market, since ultimately the short seller has to buy the shares he's sold to someone else; and so the new ban on short-selling selected financials has removed the floor beneath them. Jim in San Marcos found he couldn't do any short-selling in that sector for three hours yesterday, and doesn't know whether that means we're looking at free-fall or a sudden rally. Either way, it seems to prove the point that banning short-selling increases volatility, the sensible investor's enemy and the gambler's fatal siren.

If two views make a market, does silencing one leave the other free to become a whimsical dictator?

Karl Denninger points out that short-selling actually acts as a kind of price support in the market, since ultimately the short seller has to buy the shares he's sold to someone else; and so the new ban on short-selling selected financials has removed the floor beneath them. Jim in San Marcos found he couldn't do any short-selling in that sector for three hours yesterday, and doesn't know whether that means we're looking at free-fall or a sudden rally. Either way, it seems to prove the point that banning short-selling increases volatility, the sensible investor's enemy and the gambler's fatal siren.

If two views make a market, does silencing one leave the other free to become a whimsical dictator?

Inequality revisited

"...both the income share earned by the top 1 percent of tax returns and the tax share paid by that top 1 percent have once again reached all-time highs," says Russell Roberts at Cafe Hayek, quoting the Tax Foundation.

As we've seen recently, there's more than one way to interpret the facts. At what point do the rich cease to inspire those beneath them, and begin to squeeze them? Doesn't it take money to make money? If so, shouldn't the lower orders be left with some after paying their bills? Is there an optimum level for the Gini Index?

UPDATE

Trevor Phillips on inequality on Britain: "People can see the economic slowdown coming. Everyone is happy to take some of the pain as long as that pain is shared fairly and what we want to do is to make sure that the burden doesn't fall unfairly on some groups rather than others."

As we've seen recently, there's more than one way to interpret the facts. At what point do the rich cease to inspire those beneath them, and begin to squeeze them? Doesn't it take money to make money? If so, shouldn't the lower orders be left with some after paying their bills? Is there an optimum level for the Gini Index?

UPDATE

Trevor Phillips on inequality on Britain: "People can see the economic slowdown coming. Everyone is happy to take some of the pain as long as that pain is shared fairly and what we want to do is to make sure that the burden doesn't fall unfairly on some groups rather than others."

Sunday, July 20, 2008

Inequality

An anonymous spam-rant comment on one of my recent posts claimed that 1% of Americans owned 50% of the wealth, and this was destroying the system. Is it really a problem? I've had a quick trawl for information on inequality.

Richest 2% Own Half World Wealth; Bottom 50% Own 1% - UN Report (5 December 2006)

"the richest 1% of adults alone owned 40% of global assets in the year 2000"

The wealth gap is widening again (Daily Mail, 26 June 2008)

Why is the 'wealth gap' a bad thing? (MSNBC says it's not, what matters is opportunity)

Wealth gap widens (CNN, 29 August 2006)

"In the early 1960s, the top 1 percent of households in terms of net worth held 125 times the median wealth in the United States. Today, that gap has grown to 190 times..."

Wealth Gap Is Increasing, Study Shows (ScienceDaily, 9 August 2007)

"The poorest ten percent of families actually had a negative net worth---more liabilities than assets..."

*** Sackerson's Prophet Prize for this: ***

Globalization Has Increased the Wealth Gap (interview with Nobel prize-winning economist Joseph Stiglitz , author of "Globalization and Its Discontents", posted 15 January 2007)

"I think we are in a precarious position. We might be lucky and wander our way through this mess. There is a significant probability, however, that global interest rates could rise. If that happened, households with a large amount of debt would find it very difficult to meet their mortgage payments, and home prices would go down, which would lead to a reduction in consumption. Last year Americans consumed more than their income, something that is obviously not sustainable. The only way they could get away with it was by taking out money from their houses. But if home prices go down, they won't be able to do that any more. So there is a significant risk of a large economic slowdown. And government, by piling on so much debt and having such a large deficit, does not have much room to maneuver."

Why the wealth gap keeps growing (essay by Paul van Eeden, 17 November 2006)

"The fact is that people all over the world are getting poorer -- not because of free enterprise, open markets or globalization but because government created monetary inflation robs them of their living standards. The only ones who can immunize themselves are those with sufficient capital and that is why the rich get richer and the poor get poorer."

- Gini Index/Coefficient of inequality explained here

- Wikipedia lists countries by inequality here

- The CIA Factbook gives the Gini Index of the USA as 45 (in 2007), the UK as 34 (in 2005)

- Increase of USA's Gini coefficient since 1967 here

Richest 2% Own Half World Wealth; Bottom 50% Own 1% - UN Report (5 December 2006)

"the richest 1% of adults alone owned 40% of global assets in the year 2000"

The wealth gap is widening again (Daily Mail, 26 June 2008)

Why is the 'wealth gap' a bad thing? (MSNBC says it's not, what matters is opportunity)

Wealth gap widens (CNN, 29 August 2006)

"In the early 1960s, the top 1 percent of households in terms of net worth held 125 times the median wealth in the United States. Today, that gap has grown to 190 times..."

Wealth Gap Is Increasing, Study Shows (ScienceDaily, 9 August 2007)

"The poorest ten percent of families actually had a negative net worth---more liabilities than assets..."

*** Sackerson's Prophet Prize for this: ***

Globalization Has Increased the Wealth Gap (interview with Nobel prize-winning economist Joseph Stiglitz , author of "Globalization and Its Discontents", posted 15 January 2007)

"I think we are in a precarious position. We might be lucky and wander our way through this mess. There is a significant probability, however, that global interest rates could rise. If that happened, households with a large amount of debt would find it very difficult to meet their mortgage payments, and home prices would go down, which would lead to a reduction in consumption. Last year Americans consumed more than their income, something that is obviously not sustainable. The only way they could get away with it was by taking out money from their houses. But if home prices go down, they won't be able to do that any more. So there is a significant risk of a large economic slowdown. And government, by piling on so much debt and having such a large deficit, does not have much room to maneuver."

Why the wealth gap keeps growing (essay by Paul van Eeden, 17 November 2006)

"The fact is that people all over the world are getting poorer -- not because of free enterprise, open markets or globalization but because government created monetary inflation robs them of their living standards. The only ones who can immunize themselves are those with sufficient capital and that is why the rich get richer and the poor get poorer."

Market manipulation in financials?

Mish refers us to a piece in Minyanville. It suggests a recently introduced selective ban on short-selling is intended to support share prices in financials, so that more money can be drawn in by splitting shares and selling new tranches to the public.

To me, it feels like touting for sucker money. What happens later, when the short-selling ban is lifted? When the government (via regulators) begins to manipulate the market in this way, it looks like a sign that we are in trouble.

To me, it feels like touting for sucker money. What happens later, when the short-selling ban is lifted? When the government (via regulators) begins to manipulate the market in this way, it looks like a sign that we are in trouble.

Saturday, July 19, 2008

Should sterling now decline against the US dollar?

Mish thinks so, now we've decided to borrow our way out of a recession.

Also interesting to hear the discussion on Radio 4's Any Questions, where the assertion that Gordon had stuck to the EU's "40% of GDP" borrowing guideline wasn't challenged by anyone, despite the massive off-book PFI financing.

Also interesting to hear the discussion on Radio 4's Any Questions, where the assertion that Gordon had stuck to the EU's "40% of GDP" borrowing guideline wasn't challenged by anyone, despite the massive off-book PFI financing.

Subscribe to:

Posts (Atom)