Reading Michael Wolff's article in the Spectator today, I was struck by the uncanny resemblance of his subject to another. Here, with only a few substitutions, cuts and emendations, is my version.

Blair’s big secret is that he doesn’t have one

Wednesday, 26th November 2008

Sackerson reveals how he secured Tony Blair’s co-operation for his biography and discovered that this political titan has no interest in posterity. He is, at heart, a political operator

There is, on the one hand, the unparalleled national dominance in politics that Tony Blair and his New Labour have achieved. And yet, on the other, there’s an almost endearing attention-deficit lack of organisation and heedlessness that I witnessed in many years of chatting with Blair and his ministers.

The fact that I was talking so often and so openly with Blair was as good an example as any of the absence of planning and strategy that backs up one of the country’s greatest control freaks. Indeed, throughout the company, people kept saying to me (and among themselves): has he lost his mind, spilling the beans? Why is he doing this? What is he thinking?

The answer involves, I believe, New Labour’s essential political advantage and fundamental personality trait: Blair and Labour act without thinking very much. Or the only sustained thinking that goes on is about what he might be thinking. And that’s extremely hard because the man, contravening all rules of modern analytic politics, acts almost entirely on impulse — his method is all based on instinct, urge, gossip (i.e. a more or less random collection of things he’s been told), and the impelling force of immediate and casual circumstance. It’s serious ADD.

It was during his takeover in the 1990s of the Labour Party — a set of brilliantly executed strategic moves that occurred mostly without any kind of analysis about why he might be changing it and what he would be getting after he took charge — that Blair and I began our interviews. I had gone to the publisher of my last book and argued that there might be a chance Blair would agree to a long exclusive interview — the kind which, out of impatience or defensiveness, he had never granted. I sensed he might be open to the attention — that he was proud of winning the Labour Party.

Blair found himself talking to me with no plan or agreement or understanding or even time constraints. For the first several years of our interviews, he was clearly wondering how it was that I had got there. Only the fact that he is a very polite man, and conflict averse — at least in a one-to-one sense — kept him, I often felt, from tossing me out on my ear.

The vastness of an organisation like New Labour, dominating nearly every political platform in the country, makes it perceptually almost impossible not to believe that there is a vision here, a method and a far-reaching intelligence (pernicious or otherwise).

This was what I obviously tried to probe, sitting with Blair for nine months. What’s going on in there? What does he know?

To be with Blair, to view him, to get inside his head, and to understand how he does political, you have to take away all technology — that is, all the web-searches, all the data, all the correspondence, all the communications resources, that ministers everywhere rely on. Blair, at 55, can’t use a computer, doesn’t get email, can’t get his cell phone to work properly, can’t even imagine changing the variables on a spread sheet. (The fact that New Labour often bills itself as a technologically farsighted, aggressive and clever party is amusing to everyone there.) During the campaign to take over New Labour, Blair’s spies and surrogates would email Blair’s 54-year-old wife, Cherie, and she’d read to him from her mobile phone. Indeed, while many people at New Labour were trying to talk about the cross-platform synergies at New Labour and the future of electronic voting, Blair was only ever talking about the Party.

Psychologically, he is far from modern too. He can’t question his own motivations (a curious problem for a biographer). He truly doesn’t believe in interpretation. His face draws back, and he scowls in a remarkably dismissive way if you try to suggest that there might be a deeper pattern to his actions — that there might be meaning beyond living to fight another day. Accordingly, he has surrounded himself with a cadre of unanalysed people who believe it’s best to act before thinking too much. Curiously, his children are reasonably nuanced thinkers, which is perhaps one reason he thinks they are the most brilliant people in the country.

He has no historic interest — even in himself. This sets him at odds from most men of accomplishment, who generally cherish all their achievements. Blair hardly remembers his. The past has receded. He cuts himself off from it. In conversation, he often loses or transposes decades. This is only partly age. More to the point, he obviously has no use for memory. That’s a distraction. He is not demoralised by defeats. He’s not aggrandised by victories. When you interview him, you can’t, profitably, ask about what has occurred, you can only engage with him if you talk about what’s going on now. What’s on your mind this morning, Mr B? Who are you feeling competitive with today? What fly is buzzing near your face?

He is, and runs his career like, an ambitious man. He’s a dealmaker. No more, no less. No better, no worse. What he values is the ability and inclination to make split-second decisions. He’s rather proud when that ability is not slowed by too much information or explanation. He is most motivated by the last interesting thing someone told him — whether it is true is not as important as how it will read. Sitting with Blair for so many years, I’d regularly see the odd bits of information come in (my stock obviously went up when I offered him a tidbit), and be directed to a political researcher, or become part of his world-view or some instant political decision-making process. (At a cocktail party, he meets someone from Afghanistan, who suddenly informs his view of that conflict; at another party he meets someone who knows a policeman on Long Island, and that colours his view about a lecture tour in New York) He has no interest in understanding himself, because he sees himself as an everyman. He’s Mr Basic, Mr Uncomplicated; he has no airs, no fancy aspirations. He can trust his own gut. And why should he remember the past, he has to be in tomorrow’s papers? And once again beat the competition.

I have sometimes had the feeling, over the past years of talking to Blair and New Labour ministers, that his people are humouring him. That he is not so much, in Alistair Campbell’s formulation, the Sun God, who people cannot question, but instead a sort of long-running joke in which everybody at New Labour — so many of them career employees — is complicit. The joke is that this greatest of modern political men, the architect of the synergised, cross-platform, integrated, national political party, has no vision, no method, no strategy. Nor, likewise, does this man, perhaps the individual with the single most powerful political voice of our time, have any politics — save for what makes for good newspaper copy or puts money in his own pocket. Rather it’s all made up — what he buys, how he spends, what he believes, who he supports — on the fly.

In my interviews, Blair, even though a professional in the political world, was guileless — or ultimately unconcerned. It was a book, for one thing, and, as his advisers suggested to me, he might never have read one. What’s more, to think about how he might be portrayed would be to have an idea of his own self — to have to dwell on things he is incapable of or vastly uninterested in dwelling on. And yet he did it — blabbered away for years. With hardly a thought he exposed himself, his family and all his ministers to a biographer who one day happened to walk into his office. Even prospective immortality is something, at New Labour, which you just throw against the wall and see if it sticks.

*** FUTURE POSTS WILL ALSO APPEAR AT 'NOW AND NEXT' : https://rolfnorfolk.substack.com

Saturday, November 29, 2008

Friday, November 28, 2008

Damian Green update

I've just heard Geoff Hoon on Radio 4's "Any Questions?" trying to defend the arrest etc. of MP Damian Green. I can only think he was chosen because he is somehow politically expendable. The transcript will be available in a few days here.

His Wikipedia entry says "His notorious skill is 'stonewalling' - deflecting difficult questions by 'playing a straight bat', or appearing to do so." Maybe so. But all it did - for me and the audience - was pretty much to damn him, and by implication the government.

His Wikipedia entry says "His notorious skill is 'stonewalling' - deflecting difficult questions by 'playing a straight bat', or appearing to do so." Maybe so. But all it did - for me and the audience - was pretty much to damn him, and by implication the government.

Default is mine

A warning from history

"Those who cannot remember the past are condemned to repeat it" - George Santayana

I can't hope to improve on Cranmer's piece regarding Speaker Martin's betrayal of the proudest tradition of his office; I can only echo his cry of "Shame!"

UPDATE

Yet, alas, even Speaker Lenthall had his regrets:

In his will, Lenthall asked to be buried without any state and without a monument, 'acknowledging myself to be unworthy of the least outward regard in this world and unworthy of any remembrance that hath been so great a sinner'. The most he would permit was a plain stone carved with the Latin inscription Vermis sum, which means: I am a worm.

What epitaph will Speaker Martin cause to be inscribed for himself?

Handy-dandy, the pigs are the farmers

Place your political parties in the schema below: At first, I wondered what Hatfield Girl was talking about. Now it's one of the news headlines on the morning radio, and in the papers: the Government has taken to arresting members of the Opposition, like tinpot dictators in faraway countries that it's difficult to believe really exist.

At first, I wondered what Hatfield Girl was talking about. Now it's one of the news headlines on the morning radio, and in the papers: the Government has taken to arresting members of the Opposition, like tinpot dictators in faraway countries that it's difficult to believe really exist.

At first, I wondered what Hatfield Girl was talking about. Now it's one of the news headlines on the morning radio, and in the papers: the Government has taken to arresting members of the Opposition, like tinpot dictators in faraway countries that it's difficult to believe really exist.

At first, I wondered what Hatfield Girl was talking about. Now it's one of the news headlines on the morning radio, and in the papers: the Government has taken to arresting members of the Opposition, like tinpot dictators in faraway countries that it's difficult to believe really exist.

Difficult to believe; that's part of the process. Honestly, I have felt since 1997 (and I am no natural Conservative voter, please believe me) that something was obscurely wrong, that we were all inside someone else's dream. It's like that feeling you get that you've forgotten something, but haven't a clue what it might be.

Before 1997, the Government was Them and we were Us: British, muddling through, ready to heave a brickbat at these clowns who pretend to rule us, but all of us bound by habit and tradition. But in Tony Blair's revolution, the Government claimed to represent all of us: it was the political wing of the British people as a whole, or some such typical Toni verbalfluff.

This is how Nazism took hold - and my mother lived through it. No need for the unions, we the national socialist State represent the worker's best interests, etc.

Fascism, Communism - it's all the same, structurally.

Thursday, November 27, 2008

Economics doesn't describe the real world

Michael Panzner has unearthed a couple of good items explaining how the assumptions of classical economics are plain wrong - we are not rational - and so the results are also wrong.

And there I was, planning to use some of my Christmas holiday reading an economics primer.

And there I was, planning to use some of my Christmas holiday reading an economics primer.

Wednesday, November 26, 2008

What is debt?

Here's one way to calculate it (htp: Burning Our Money): GDP less debt owed to foreigners, per capita.

Here's one way to calculate it (htp: Burning Our Money): GDP less debt owed to foreigners, per capita.But there's also total debts (foreign and domestic) compared to GDP, in which case the US owes 4 times what it earns, and goodness knows exactly what the equivalent is here in the UK.

And then there's future liabilities - pensions and healthcare costs that have effectively been promised, and will have to be paid for decades to come. The US Comptroller General, David Walker, has been touring the US for two years like Cassandra of Troy, trying to alert the public about this. His latest reported estimate is that these promises are equivalent to a lump sum debt of $53 trillion, and rising annually by $2 - $3 trillion.

It's an unholy mess, on a scale so large that even approximate calculations seem almost irrelevant. However, I strongly suspect that it is a misrepresentation to say that the problem is principally American. If only the truth were made plain - but those in the best position to say, have the greatest incentive to remain silent, or to mislead us.

Monday, November 24, 2008

If the 2003 reflation hadn't happened?

What if the banks hadn't gone for broke from 2002/2003 onward?

What if the banks hadn't gone for broke from 2002/2003 onward?In the above graph, I show the Dow, adjusted for CPI, up to 19 November 2008, with an extra: the gold line is the same as what actually happened from the beginning of 1966 to November 1974, adjusted proportionately to the height of the boom at the end of 1999.

Interpreted and represented in this way, even the worst of the crash so far has not caught up with the mid-70s: the Dow closed last Wednesday at 7,997 where 32 years before it would have been the equivalent of 4,911. If that period of history were to repeat itself, the Dow would take another 7 years of whipsawing towards its low of 3,988 in today's terms.

So in my view, the monetary expansion of the last 6 years or so, has merely delayed progress a little. The drunkard has had a few more to put off the hangover.

What if...

Today we learn that UK Police forces have become excited about the possibilities of stun guns. No doubt once they've been issued, there'll be a race to escalate the usage, in the same way that you make gallons of ice cream or larders full of bread, once you've bought the device. Just wait for the trigger-happy traffic warden or lollipop lady.

Coincidentally, the following comes by email across the Atlantic. I've seen it before, I think, but I also think it may well be largely true.

Pocket Taser Stun Gun, a great gift for the wife. A guy who purchased his lovely wife a pocket Taser for their anniversary submitted this:

Last weekend I saw something at Larry's Pistol & Pawn Shop that sparked my interest. The occasion was our 15th anniversary and I was looking for a little something extra for my wife Julie. What I came across was a 100,000-volt, pocket/purse-sized taser. The effects of the taser were supposed to be short lived, with no long-term adverse affect on your assailant, allowing her adequate time to retreat to safety....??

WAY TOO COOL! Long story short, I bought the device and brought it home.

I loaded two AAA batteries in the darn thing and pushed the button.

Nothing!

I was disappointed . I learned, however, that if I pushed the button AND pressed it against a meta surface at the same time; I'd get the blue arc of electricity darting back and forth between the prongs. AWESOME!!! Unfortunately, I have yet to explain to Julie what that burn spot is on the face of her microwave.

Okay, so I was home alone with this new toy, thinking to myself that it couldn't be all that bad with only two triple-A batteries, right? There I sat in my recliner, my cat Gracie looking on intently (trusting little soul) while I was reading the directions and thinking that I really needed to try this thing out on a flesh & blood moving target. I must admit I thought about zapping Gracie (for a fraction of a second) and thought better of it. She is such a sweet cat. But, if I was going togive this thing to my wife to protect herself against a mugger, I did want some assurance that it would work as advertised. Am I wrong?

So, there I sat in a pair of shorts and a tank top with my reading glasses perched delicately on the bridge of my nose, directions in one hand, and taser in another. The directions said that a one-second burst would shock and disorient your assailant; a two-second burst was supposed to cause muscle spasms and a major loss of bodily control; a three-second burst would purportedly make your assailant flop on the ground like a fish out of water. Any burst longer than three seconds would be wasting the batteries.

All the while I'm looking at this little device measuring about 5' long, less than 3/4 inch in circumference; pretty cute really and (loaded with two itsy, bitsy triple-A batteries) thinking to myself, 'no possible way!'

What happened next is almost beyond description, but I'll do my best...?

I'm sitting there alone, Gracie looking on with her head cocked to one side as to say, 'don't do it dipshit,' reasoning that a one second burst from such a tiny little ole thing couldn't hurt all that bad. I decided to give myself a one second burst just for heck of it.. I touched the prongs to my naked thigh, pushed the button, and . . HOLY MOTHER OF GOD . . WEAPONS OF MASS DESTRUCTION . . . WHAT THE HELL!!!

I'm pretty sure Jessie Ventura ran in through the side door, picked me up in the recliner, then body slammed us both on the carpet, over and over and over again. I vaguely recall waking up on my side in the fetal position, with tears in my eyes, body soaking wet, both nipples on fire, testicles nowhere to be found, with my left arm tucked under my body in the oddest position, and tingling in my legs? The cat was making meowing sounds I had never heard before, clinging to a picture frame hanging above the fireplace, obviously in an attempt to avoid getting slammed by my body flopping all over the living room.

Note: If you ever feel compelled to 'mug' yourself with a taser, one note of caution: there is no such thing as a one second burst when you zap yourself! You will not lt go of that thing until it is dislodged from your hand by a violent thrashing about on the floor.. A three second burst would be considered conservative?

IT HURT LIKE HELL!!!

A minute or so later (I can't be sure, as time was a relative thing at that point), I collected my wits (what little I had left), sat up and surveyed the landscape. My bent reading glasses were on the mantel of the fireplace. The recliner was upside down and about 8 feet or so from where it originally was. My triceps, right thigh and both nipples were still twitching. My face felt like it had been shot up with Novocain, and my bottom lip weighed 88 lbs. I had no control over the drooling. Apparently I pooped on myself, but was too numb to know for sure and my sense of smell was gone. I saw a faint smoke cloud above my head which I believe came from my hair. I'm still looking for my nuts and I'm offering a significant reward for their safe return!!

P.S. My wife loved the gift, and now regularly threatens me with it! 'If you think education is difficult, try being stupid.'

Coincidentally, the following comes by email across the Atlantic. I've seen it before, I think, but I also think it may well be largely true.

Pocket Taser Stun Gun, a great gift for the wife. A guy who purchased his lovely wife a pocket Taser for their anniversary submitted this:

Last weekend I saw something at Larry's Pistol & Pawn Shop that sparked my interest. The occasion was our 15th anniversary and I was looking for a little something extra for my wife Julie. What I came across was a 100,000-volt, pocket/purse-sized taser. The effects of the taser were supposed to be short lived, with no long-term adverse affect on your assailant, allowing her adequate time to retreat to safety....??

WAY TOO COOL! Long story short, I bought the device and brought it home.

I loaded two AAA batteries in the darn thing and pushed the button.

Nothing!

I was disappointed . I learned, however, that if I pushed the button AND pressed it against a meta surface at the same time; I'd get the blue arc of electricity darting back and forth between the prongs. AWESOME!!! Unfortunately, I have yet to explain to Julie what that burn spot is on the face of her microwave.

Okay, so I was home alone with this new toy, thinking to myself that it couldn't be all that bad with only two triple-A batteries, right? There I sat in my recliner, my cat Gracie looking on intently (trusting little soul) while I was reading the directions and thinking that I really needed to try this thing out on a flesh & blood moving target. I must admit I thought about zapping Gracie (for a fraction of a second) and thought better of it. She is such a sweet cat. But, if I was going togive this thing to my wife to protect herself against a mugger, I did want some assurance that it would work as advertised. Am I wrong?

So, there I sat in a pair of shorts and a tank top with my reading glasses perched delicately on the bridge of my nose, directions in one hand, and taser in another. The directions said that a one-second burst would shock and disorient your assailant; a two-second burst was supposed to cause muscle spasms and a major loss of bodily control; a three-second burst would purportedly make your assailant flop on the ground like a fish out of water. Any burst longer than three seconds would be wasting the batteries.

All the while I'm looking at this little device measuring about 5' long, less than 3/4 inch in circumference; pretty cute really and (loaded with two itsy, bitsy triple-A batteries) thinking to myself, 'no possible way!'

What happened next is almost beyond description, but I'll do my best...?

I'm sitting there alone, Gracie looking on with her head cocked to one side as to say, 'don't do it dipshit,' reasoning that a one second burst from such a tiny little ole thing couldn't hurt all that bad. I decided to give myself a one second burst just for heck of it.. I touched the prongs to my naked thigh, pushed the button, and . . HOLY MOTHER OF GOD . . WEAPONS OF MASS DESTRUCTION . . . WHAT THE HELL!!!

I'm pretty sure Jessie Ventura ran in through the side door, picked me up in the recliner, then body slammed us both on the carpet, over and over and over again. I vaguely recall waking up on my side in the fetal position, with tears in my eyes, body soaking wet, both nipples on fire, testicles nowhere to be found, with my left arm tucked under my body in the oddest position, and tingling in my legs? The cat was making meowing sounds I had never heard before, clinging to a picture frame hanging above the fireplace, obviously in an attempt to avoid getting slammed by my body flopping all over the living room.

Note: If you ever feel compelled to 'mug' yourself with a taser, one note of caution: there is no such thing as a one second burst when you zap yourself! You will not lt go of that thing until it is dislodged from your hand by a violent thrashing about on the floor.. A three second burst would be considered conservative?

IT HURT LIKE HELL!!!

A minute or so later (I can't be sure, as time was a relative thing at that point), I collected my wits (what little I had left), sat up and surveyed the landscape. My bent reading glasses were on the mantel of the fireplace. The recliner was upside down and about 8 feet or so from where it originally was. My triceps, right thigh and both nipples were still twitching. My face felt like it had been shot up with Novocain, and my bottom lip weighed 88 lbs. I had no control over the drooling. Apparently I pooped on myself, but was too numb to know for sure and my sense of smell was gone. I saw a faint smoke cloud above my head which I believe came from my hair. I'm still looking for my nuts and I'm offering a significant reward for their safe return!!

P.S. My wife loved the gift, and now regularly threatens me with it! 'If you think education is difficult, try being stupid.'

Sunday, November 23, 2008

River deep, mountain high

How long do bear markets last?

How long do bear markets last?There's how long the market takes to bottom-out, and then also how long it takes to match its previous peak. In real terms (adjusted for CPI), here's the last two Dow bears:

1929: 3 years to hit bottom, lost 86% of its peak value, in all took over 29 years (i.e. in 1958) to match its 1929 high; then a further 8 years to reach a new record top

1966: 16 years to hit bottom, lost 73% of its peak value, in all took over 29 years (i.e. in 1995) to match its 1966 high; then a further 4 years to reach a new record top

1999: ...

See you back on the high slopes in 2029?

The crushing weight of debt

US GDP is estimated at $14.3 trillon, and the Chinese article referenced in my post yesterday calculated total debts to be $68.5 trillion. The average interest rate on Federal debt in October was 4.009%.

So if that interest rate applied to all debts in the US, it would equate to 19.2% of GDP. In other words, $19.20 out of every 100 dollars earned simply pays interest. But private borrowing costs more, so the real burden is even greater.

Worse still is the fact that debts have been rapidly increasing for years. A study by the Foundation for Fiscal Reform calculates that debt-to-GDP rose from 249% in 1983 to 392% earlier this year, an average increase of nearly 6% (of GDP) per year; actually, accelerating faster than that in the last few years.

So merely to go no further into debt, plus paying interest without ever repaying capital, would cost at least 25% of GDP. And if there were (please!) a plan to abolish all debt by the beginning of the next century (92 years away), that would add another 5% or so, bringing the total national debt servicing to 30% of GDP.

Having got to this breakneck speed, there is no difference between stopping and crashing.

I suspect there simply must be debt destruction - either slowly, in the form of currency devaluation, or quickly, in debt writeoffs and defaults.

So if that interest rate applied to all debts in the US, it would equate to 19.2% of GDP. In other words, $19.20 out of every 100 dollars earned simply pays interest. But private borrowing costs more, so the real burden is even greater.

Worse still is the fact that debts have been rapidly increasing for years. A study by the Foundation for Fiscal Reform calculates that debt-to-GDP rose from 249% in 1983 to 392% earlier this year, an average increase of nearly 6% (of GDP) per year; actually, accelerating faster than that in the last few years.

So merely to go no further into debt, plus paying interest without ever repaying capital, would cost at least 25% of GDP. And if there were (please!) a plan to abolish all debt by the beginning of the next century (92 years away), that would add another 5% or so, bringing the total national debt servicing to 30% of GDP.

Having got to this breakneck speed, there is no difference between stopping and crashing.

I suspect there simply must be debt destruction - either slowly, in the form of currency devaluation, or quickly, in debt writeoffs and defaults.

Presumed Consent revisited

Most of us know by now that the government wants to increase rates of organ donation by assuming the right to our bodies the moment we cease to breathe, unless we opt-out of their grisly clutches. Jimmy Young in the Sunday Express notes the failure of such schemes in Brazil and France, for example.

My wife points out that in England, it has always been the law that the body of the deceased belongs to the next of kin. Or has that gone by the board since the EU abolished our country's sovereign right to make its own law?

What has happened to the Common Law, Natural Justice, The Reasonable Man and the long, bloodily-won fight to assert the Englishman's rights against the overweening powers of the State?

And will these things have to be re-won by bloody resistance, one day?

My wife points out that in England, it has always been the law that the body of the deceased belongs to the next of kin. Or has that gone by the board since the EU abolished our country's sovereign right to make its own law?

What has happened to the Common Law, Natural Justice, The Reasonable Man and the long, bloodily-won fight to assert the Englishman's rights against the overweening powers of the State?

And will these things have to be re-won by bloody resistance, one day?

Bank crashes and the Basel Accords

I need information and understanding - please help me, somebody.

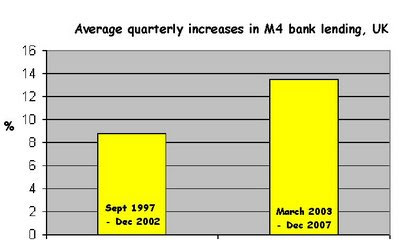

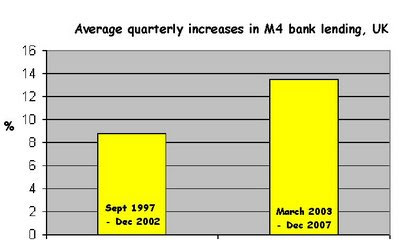

I've pointed out more than once that M4 bank lending in the UK accelerated from 2003 on, and I suspected it was something to do with reducing bank capital adequacy requirements, so the government (via its regulators) would have been implicated. In other words, I've been looking for the villain of the piece, and the smoking gun.

But do you think I can find them?

What I have found so far is references to the Basel Accords, Basel I and Basel II. Basel I became law in the G10 countries including the UK in 1992, and Basel II was published in 2004. The general drift, I understand, is to encourage a uniformity of approach to systemic financial risk, and to introduce a system of risk-weighting bank capital according to what the banks are lending against or investing in. What a success that has proved! Perhaps we should refer to the scheme as "Basel Fawlty".

But can somebody help unpack and simplify what actually happened? Is it, for example, possible that this system was perceived by the banks as a more pliable alternative to fixed minimum reserve ratios, and so they reduced the cash in their vaults to the very least that they could tweak the definitions? For example, we have read many times how mortgage-backed securities are at the heart of the subprime problem, because the packages could be represented as having much less risk than they actually contained.

So is the present crisis an unintended consequence of more elastic international regulation, dating back as far as the early 1990s?

Saturday, November 22, 2008

It's good news week

Im all the gloom, a ray of light: Kiva has just hit $50 million in micro-loans to poor entrepreneurs around the world. Join one of their teams - I have (click on logo in sidebar).

The sixfold path to Chinese hegemony

The Mogambo Guru does a (tragi-) comedy riff on a Chinese piece he's read. Here's a list of tunes that the Chinese author is calling the piper to play:

1. The US should cancel the limits on high-tech exports to China, and allow China to acquire advanced technology and high-tech companies from the US

2. The US needs to open its financial system to Chinese financial institutions, allowing all Chinese financial firms to open branches and develop business in the US

3. The US should not prevent Europe from canceling the ban against selling weapons to China

4. The US should stop selling military weapons to Taiwan

5. The US should loosen its limits on numbers of Chinese tourists and allow them to travel freely to the US

6. The US should never restrain China’s exports to the US and force RMB appreciation in the name of domestic protectionism and employment pressure

Given the relationship between government and journalism in China, I half-suspect that the article may have had input, shall we say, from official sources. Looking at the implications of these demands, we may begin to tremble.

Below, I put in graph from the statistics quoted in that article. To my layman's mind, it's clear that bailouts transferring debt from other piles to the national pile, are a waste of time: it's debt cancellation that's needed.

Friday, November 21, 2008

Publish the lot

Currently there's a furore over here about the publication on the internet of the membership of the British National Party. Some of them look like scrubbed-up thugs, it's true, but I can't see them ever being anything but a cranky and resentful minority. However, if you are a policeman and hold officially-unapproved views, you will lose your job; and there are others for whom this cyber-unmasking will prove a permanent block in their careers.

But if we really want to set the cat among the pigeons, let's make public all political party membership, past and present. Then let's correlate the information with employment. For I recall reading in the 70s that it was pretty much career suicide for teachers in some London boroughs not to be members of the Labour Party, and I suspect the same issue would apply in other areas and other lines of work. And how about mapping the complex network of personal and employment-related relationships, as was done so damningly for Macmillan's government?

And who was in the International Marxist Group and other left-wing, semi-secret societies? The present Minister for "Justice", Jack Straw, has, I understand, called for and either weeded or destroyed the file on himself years ago, a luxury not afforded to many of us. And who went to those annually-advertised Marxist "summer schools" and carefully didn't join a political party, or let their membership lapse to maintain radio silence in their future missions?

Maybe we'll see where the real danger lies.

But if we really want to set the cat among the pigeons, let's make public all political party membership, past and present. Then let's correlate the information with employment. For I recall reading in the 70s that it was pretty much career suicide for teachers in some London boroughs not to be members of the Labour Party, and I suspect the same issue would apply in other areas and other lines of work. And how about mapping the complex network of personal and employment-related relationships, as was done so damningly for Macmillan's government?

And who was in the International Marxist Group and other left-wing, semi-secret societies? The present Minister for "Justice", Jack Straw, has, I understand, called for and either weeded or destroyed the file on himself years ago, a luxury not afforded to many of us. And who went to those annually-advertised Marxist "summer schools" and carefully didn't join a political party, or let their membership lapse to maintain radio silence in their future missions?

Maybe we'll see where the real danger lies.

Moral hazard and white-collar crime

I've said several times that I think a benchmark punishment for those financiers who have very nearly destroyed us with, if not criminal intent, then culpable ignorance, should be the repayment of their last 5 years' bonuses.

Harsh, one may think; unreasonable. Surely this would bankrupt many and leave them homeless.

Well, what is happening now to thousands of the victims of their greedy schemes across America and Britain? Men seeing the disappointment and cooling affection in their women's eyes, feeling the ardour of embraces replaced by demoralising reassurance, knowing that after the comfort comes recrimination; women worrying about their men's fidelity and sobriety, about their own security and the safety of their children; education disrupted, futures blighted.

A long-running motif in public affairs here and presumably across the Atlantic has been "getting away with it". You will all have your own list of those who have been rewarded for misbehaviour. Without fitting retribution, society will continue to crumble. This is not about vengeance, but about making whole.

Harsh, one may think; unreasonable. Surely this would bankrupt many and leave them homeless.

Well, what is happening now to thousands of the victims of their greedy schemes across America and Britain? Men seeing the disappointment and cooling affection in their women's eyes, feeling the ardour of embraces replaced by demoralising reassurance, knowing that after the comfort comes recrimination; women worrying about their men's fidelity and sobriety, about their own security and the safety of their children; education disrupted, futures blighted.

A long-running motif in public affairs here and presumably across the Atlantic has been "getting away with it". You will all have your own list of those who have been rewarded for misbehaviour. Without fitting retribution, society will continue to crumble. This is not about vengeance, but about making whole.

Thursday, November 20, 2008

The reality goggles are smeared

This project of mine is echoed by Eric Janszen of iTulip. His graph and red line suggests what I've been saying recently, that the Dow's trend (if it has one) could be to 6,000 points, with an overshoot to 4,000.

My independently-researched version:

iTulip's:

iTulip's:

My independently-researched version:

iTulip's:

iTulip's:

It's really hard to see the past in our own terms. I'm trying to do it using the Consumer Price Index, which opens another can of worms about the composition and weighting of that index, especially since (I understand) it affects government statistics and benefits. However, you have to start somewhere.

The first thing to note is how freakish recent years have been. If you connect previous start-of-month highs (August 1929, January 1966) and extended the line, you'd expect the recent Dow highs of 1999 and 2007 to be no more than 10,000 points.

And as for the lows: the drop from 1929 to 1932 was 86% "in real terms"; from 1966 to 1982, 73%; and so far since 1999, 46% - but this last from an amazing historical high. And the 350%-plus American debt-to-GDP ratio is quite unprecedented.

So the history of the last 80 years offers no clear guide as to what could happen next. If proportionately as severe as 1932, the Dow could dive to about 2,100 points; if like 1982, just below 4,000. BUT the second of these great waves crashed rather less than the first, so maybe the third will be even more merciful, perhaps a top-to-bottom fall of only 60%, i.e. end up at c. 5,900.

I note that the Dow has closed tonight at 7,552.29. What a fast fall we've seen - will it spring back sharply and then recommence its decline, as in previous cycles, or is it popping like a balloon?

Methodology

I've noted the Dow as it stood on the first trading day each month, starting October 1928 and ending November 2008 (plus where it stood yesterday - 7.997.28 - since we've seen a further steep fall). Then I've noted the historical CPI as at the end of the previous month in each case. Then, looking at the latest Dow figure, I've adjusted historical Dow figures accordingly (i.e. Dow then/CPI then, times CPI now).

Sources: Dow: Yahoo! Finance; CPI: InflationData.com

UPDATE

iTulip today also reproduces its graph on holdings at the Federal Reserve bank, underscoring the point that the current crisis has features that we can scarcely compare to anything in the last 80 years. Except that it's unlikely to be good news.

America to default on its debts?

Michael Panzner introduces the topic with an entry from the Economist blog - and look at the comments.

Wednesday, November 19, 2008

The Gadarene Swine

In a visit to old haunts, ex-Wall Street trader Michael Lewis (author of "Liar's Poker") describes how greed was turbocharged by ignorance among both the experts and the public, firing them all well beyond the edge of the precipice.

Subscribe to:

Posts (Atom)