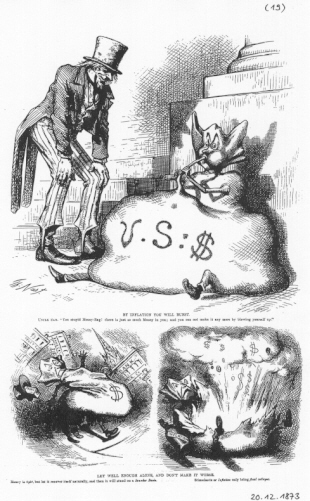

"By inflation you will burst - let well enough alone, and don't make it worse" (Thomas Nast, 20 December 1873)

"By inflation you will burst - let well enough alone, and don't make it worse" (Thomas Nast, 20 December 1873)Captions: (1) UNCLE SAM-"You stupid Money-Bag! there is just so much Money in you; and you can not make it any more by blowing yourself up." (2) Money is tight, but let it recover itself naturally, and then it will stand on a sounder basis. (3) Stimulants or inflation only bring final collapse.

The Contrarian Investor reviews the central bank intervention figures from Thursday and Friday. Totting them up, I see that's over a quarter of a trillion dollars added to the system in two days.

I cannot imagine that kind of money. But if you now invested that two-day $266.65 billion spree in US Treasury 10-year bonds at the current yield of 4.51%, it would create a secure income of over $12 billion a year.

The world's most expensive house used to belong to the king of yellow journalism. Randolph Hearst's spread is now going for around $160 million dollars. The interest on this central bank splurge would buy six of these houses every month. (At least that would be a solid support for house prices, at the top end.)

But let's put it another way. According to Jerry Bowyer in National Review Online yesterday (reproduced by CBS), the average sub-prime mortgage is for $200,000 and there are 254,000 mortgages currently in foreclosure. This works out at $50.8 billion dollars. It also means that the latest central bank cash injection is sufficient to buy out all current US mortgage foreclosures - five times over! Seemingly, it would be far cheaper for the central banks to take over this housing and rent it out.

So the real damage has been caused by the insane, or maybe one could term it criminal, leverage and speculation. The money experts are responsible for this debacle and the authorities are rushing to save them (and us) from the full consequences of their actions. This is almost a perfect example of creating a moral hazard.

No comments:

Post a Comment